This page presents the High Tide investment thesis with bull and bear scenario analysis of future revenue, market cap and share price. The page uses the format and thoughts presented in the Cannabis Portfolio page, with following sections:

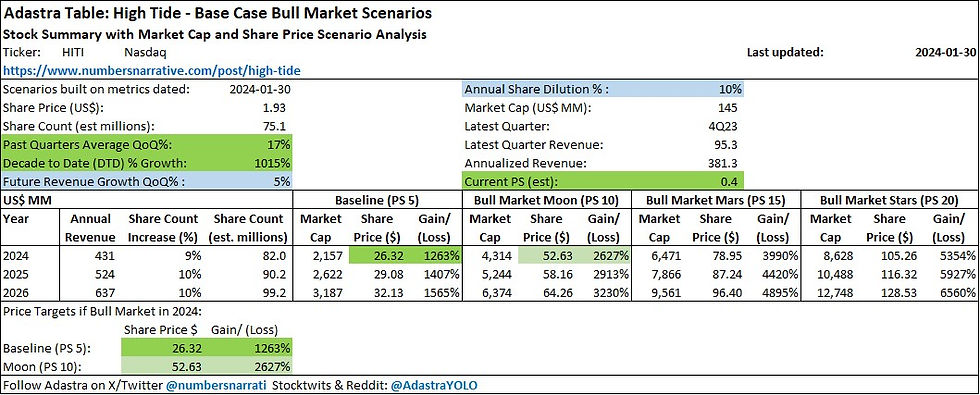

Bull and bear scenario analysis using 5% quarter over quarter (QoQ) revenue growth and 10% annual share dilution

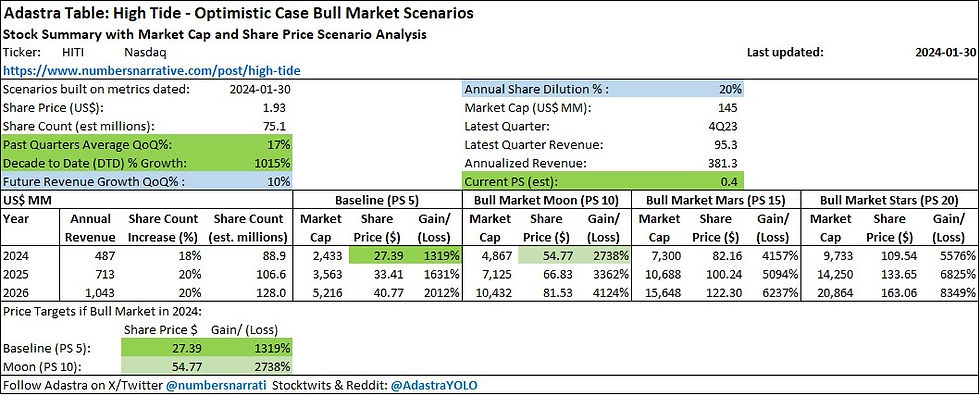

Optimistic bull and bear scenario analysis using 10% quarter over quarter (QoQ) revenue growth and 20% annual share dilution

Overview and investment thesis

The following is the official description on the website for High Tide:

High Tide is a leading retail-focused cannabis company with bricks-and-mortar as well as global e-commerce assets. Our growing network of stores across Canada is complemented by our leading, vertically-integrated position in the North American and European e-commerce space related to hemp-derived CBD and consumption accessories. This combination and our track record of execution have enabled us to consistently generate superior margins across our ecosystem. High Tide’s strategy as a parent company is to extend and strengthen its integrated value chain, while providing a complete customer experience and maximizing shareholder value.

An important step as you DYODD in any company is to review the company’s Investor Presentation and financial results. For High Tide, these are available in their Invest Page.

I would highly recommend downloading the latest Investor Presentation and studying it. There is a lot of information but it will give you an overview of their strategy, brands, performance and investment thesis. I will not repeat the content, but will mention some key points and insights.

High Tide has been categorized in my fruits analogy as an aprium, because it is vertically integrated with retail stores, ecommerce platforms, distribution and the manufacturing of accessories and nonpsychoactive cannabinoid products. It was a gladiator in the dog-eat-dog OTC exchange (Colosseum) during the previous cannabis bull market (early 2021), but now is a senator on the Nasdaq (Senate).

The company operates in primarily Canada, the US, UK and Europe, and has a different strategy and operating model for each region. I think of the operating model as the Costco model in Canada and the Amazon model in the US, UK and Europe. As shown in the Ecosystem slide of the Investor Presentation, they have 3 segments: THC, CBD and Accessories, across different markets. In Canada they sell products from all 3 segments under the retail store banner Canna Cabana.

Vertical integration through multiple ecommerce platforms, the manufacturing and distribution (through Valiant Distribution) of owned brand (Famous Brandz) accessories, has been a source of competitive advantage. In the US, UK and now Germany, they sell nonpsychoactive Cannabinoid (primarily CBD) products and accessories through multiple ecommerce platforms. Another component of their ecosystem is Cabanalytics, an analytics platform that sells data and insights to industry stakeholders.

Canada is a mature market, that was legalized in 2018. Over the years, cannabis sales grew as the legal market took market share from the illicit market, and eventually legal sales overtook illicit market sales. As legal consumption did rise, so did the number of licensed retail stores and with it came competition. High Tide has 150+ corporate owned (zero franchise model) stores across Canada. The company used the competitive advantage of its Cabanalytics platform to assess evolving market conditions and determined that customers want good quality products at value pricing. Based on these insights they launched a Costco type membership program called Cabana Club loyalty program, offering discount prices for members. This program has grown to more than a million members, contributing majority of their Canadian sales. The program has contributed impressive increases in quarterly revenues as High Tide captured market share from competitors.

In the US and UK, sales have steadily increased, driven by the acquisitions and synergies of ecommerce platforms. In 2021, High Tide acquired three cannabis accessory ecommerce platforms: Smoke Cartel, Daily High Club and Dankstop. These brought synergies like dropshipping technology and subscription boxes that were deployed over other platforms in the ecosystem. In 2021, High Tide also acquired three cannabinoid (primarily CBD) platforms: NuLeaf Naturals and FABCBD in the US, and Blessed CBD in the UK (which was later launched in Germany). These, in addition to Grasscity, make up the 7 ecommerce platforms in the High Tide ecosystem. Several US customers have reported that Grasscity and Smoke Cartel are often the highest ranked results for Google searches related to Cannabis accessories.

Smoke Cartel affiliate links have been included in several pages of this blog. The company has provided a 10% discount coupon "NUMBERSNARRATIVE" for this blog. If you are in the US, feel free to click on the links to explore products, and don't forget to use the coupon to get the discount! The banner below includes several of the bestselling products on Smoke Cartel.

It is these ecommerce platforms that make the US/UK/Europe model similar to Amazon’s ecommerce model. An important point to note is that High Tide has a global customer database exceeding 4.6 million, including 3 million customers in the US. This will be a factor in determining the feasibility of the Bull/Bear scenarios below.

FABCBD affiliate links have been included in every page of this blog. The products are very high quality with excellent reviews, and their CBD oil is ranked Best Full Spectrum CBD Oil (2022) by Forbes. The company has provided a 20% discount coupon "NUMBERSNARRATIVE" for this blog. If you are in the US, feel free to click on the links to explore products, and don't forget to use the coupon to get the discount!

FABCBD has CBD dog treats

Bull and bear scenario analysis using 5% quarter over quarter (QoQ) revenue growth and 10% annual share dilution

The base case scenarios for High Tide are built on the assumption that quarter over quarter (QoQ) revenue growth will be 5% and annual dilution of shares will be 10%. The table below shows the quarterly revenues for the decade starting Q1 2020, and future revenues forecasted with 5% sequential revenue growth.

All tables on this page will be updated frequently. Review the past performance in revenue growth, the average for past quarters and the Decade to Date (DTD) % Growth in revenue. These were incorporated in the Best Cannabis Stocks Analysis. The table with comparisons to other analyzed cannabis stocks is presented in the Revenue Growth Analysis page. The table shows an impressive 18%+ average quarterly growth in revenue and a DTD growth of nearly 1000%. Fun fact: of all the stocks analyzed in this blog, the Revenue Growth Analysis shows only one has had sequential revenue growth in every quarter in this decade, High Tide.

This now leads to what I call the Adastra charts for the base case Bull and Bear scenarios. The Bull Market Scenarios are presented in the table below.

All the scenario analyses presented here are built on the thesis that the rising tide of cannabis will be not one but two waves – the revenue growth wave and the bull market valuation wave. These tables predict the potential market cap and share price for the combined effect of these two waves, which can magnify the potential gains in share price appreciation.

This Bull market scenario analysis factors in 5% quarter over quarter (QoQ) revenue growth and 10% annual share dilution. Based on previous performance and the execution of the strategy demonstrated, I’d assess that there is a good probability that the revenue growth is achievable.

Nobody can predict when the bull market will happen. But the numbers are modelled out to 2025, and if we see bull market valuations in these years, the market cap and price targets will be driven by the PS valuations given by the market. The numbers show that if we see any of the Bull Market PS valuations (Moon 10 PS, Mars 15 PS, Stars 20 PS), impressive gains can be had.

For High Tide, the Baseline (PS 5) numbers are also important data points. Not many retail companies grow revenues at the phenomenal rate seen with High Tide. The closest I can think of is Dollarama:

Dollarama grew impressively from its IPO in 2009. As a frugal shopper I often shopped at one of their many stores in Toronto. I was also an early shareholder. I made the error of selling when the share price doubled. Instead I could have had around a 20X return had I held. That was a lesson learned the hard way. Dollarama consistently trades at a PS ratio between 4 and 5.

The other retail company with phenomenal growth that comes to mind is Lululemon Athletica, which grew with the Yoga boom. Yoga is an interest of mine and a practice that has, like cannabis, helped improve the physical, mental and spiritual wellness of countless people around the world.

Lululemon also consistently trades at a PS ratio between 5 and 12.

The cannabis industry is one of the few industries in the world experiencing phenomenal growth rates, as seen in dollar stores and Yoga clothing, studios, etc. High Tide’s growth in the decade of the 2020s is similar to the growth of Dollarama and Lululemon in the decade of the 2010s. Given High Tide’s past growth and potential growth, I believe that a PS of 5 is fair value, and hence highlight the Baseline (PS 5) numbers as important data points.

I often hear frustrated investors call High Tide a “great company, bad stock”. The frustration is understandable because the disconnect between valuation and performance is absolutely ridiculous. But the sad reality is that this is a great company in an out of favor sector – cannabis. If this company was in most other sectors, the growth would justify it trading at PS ratio of 5+. To believe that the cannabis sector will forever be unappreciated is illogical. Fundamentals tend to eventually get recognized and get reflected in market cap and share prices. There is a good probability that cannabis will eventually have a bull market and valuations across cannabis stocks will rise. When smart money (institutional investors) join the party, the most undervalued stocks with best fundamentals will likely get disproportionately higher new investment, and will potentially be the best performers.

FABCBD complete cannabinoid softgels having equal parts CBD, CBG, CBN, and CBC

Will this company survive (with limited share dilution) till the next cannabis bull market?

With the base case scenario (5% quarterly growth at 10% annual share dilution) achievable, there is a good probability that High Tide will survive till the next bull market. The probability of survival increases when we see the numbers in the AEBITDA Analysis. The numbers show that in spite of the phenomenal growth achieved, the company has reported positive AEBITDA in 100% of the quarters this decade. It is also one of the few cannabis companies that is Free Cash Flow positive. This is a well run company that combines revenue growth with cost optimization.

In the Cannabis Portfolio page I mention macro factors to consider like inflation, and consumers switching to cheaper substitutes and white label brands. Many companies might see sales decrease with inflation impacting consumer behavior. High Tide’s business model, with the Cabana Club loyalty program offering discount prices for members, sets it up for success when price is top of the mind for customers. The ecosystem is backed by the strengths from vertical integration and economies of scale. The competition, mostly smaller businesses, lack these strengths and many are likely going to fail.

The other macro factor, and contributor to high inflation, is high oil prices. Global conflicts and wars have caused oil prices to rise rise and stabilize above US$80/barrel. Oil prices are likely to remain high for several quarters, if not years. While many companies will be impacted negatively by the high oil prices, High Tide stands to benefit from it. The company is headquartered in the province of Alberta, which has the fourth-largest oil reserves in the world, after Venezuela, Saudi Arabia and Iran. The Alberta economy has benefited from the high oil prices. High Tide has a large number of Canna Cabana stores in Alberta and revenues should stay strong with the strengthening of the customer base in their home province.

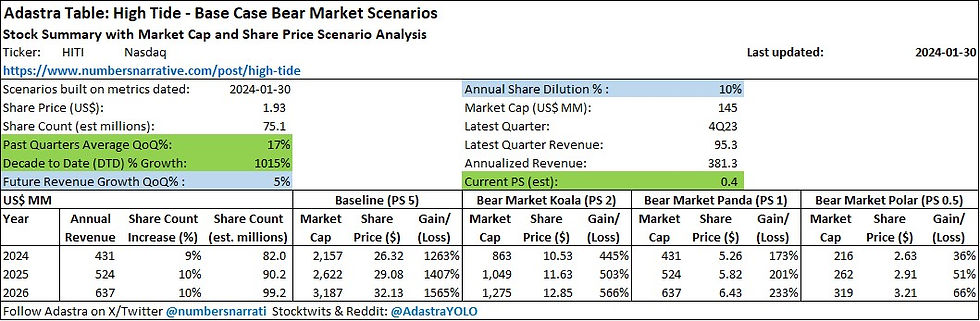

While the long term prospects for the cannabis sector are bright, in the short term there is a risk that the sector will remain out of favor and that valuations can remain low or even deteriorate further. It is important to model out Bear market scenarios based on Bear Market PS valuations (Koala Bear 2 PS, Panda Bear 1 PS, Polar Bear 0.5 PS). These Bear Market Scenarios are presented in the table below.

High Tide’s ridiculously low PS Ratio given strong revenue growth and AEBITDA results, indicate that there is limited downside potential to the share price. The only justification for lower PS valuation would be a risk of bankruptcy. I never assign 100% probability to any scenario in the cannabis sector. But based on all that I know about the company, having studied their strategy and performance since November 2020, I would assess the bankruptcy risk as low. The risk has gotten much lower as of the 2023 Q3 results, where High Tide declared that it was Free Cash Flow Positive.

Nevertheless, the Bear Market scenarios are worth reviewing to project market cap and share price for lower PS valuations.

FABCBD Anytime Gummies have 25mg of CBD along with natural ingredients like Organic Turmeric

Optimistic bull and bear scenario analysis using 10% quarter over quarter (QoQ) revenue growth and 20% annual share dilution

Now let’s look at some optimistic scenarios and assess feasibility for these scenarios. The optimistic case scenarios for High Tide are built on the assumption that quarter over quarter (QoQ) revenue growth will be 10% and annual dilution of shares will be 20%. The table below shows the quarterly revenues for the decade starting Q1 2020, and future revenues forecasted with 10% sequential revenue growth.

Review once again the past performance in revenue growth, the average for past quarters and the Decade to Date (DTD) % Growth in revenue.

This now leads to the Adastra charts for the optimistic case Bull and Bear scenarios. The Bull Market Scenarios are presented in the table below.

The revenue growth numbers seem too good to be true. The 2026 revenue projection in the optimistic scenario (10% quarterly revenue growth) is in excess of US$ 1 Billion. The company has an average quarter over quarter growth of 18% for this decade. That may not be sustainable if they are operating only in the cannabinoid and accessories markets outside Canada, and restricted to THC products only in Canada. But is this growth feasible if global markets change through legislations and cannabis friendly reforms? This brings us to the question:

Will this company thrive when legislation allows uplisting, institutional ownership and Nasdaq/NYSE listed companies to sell THC products in the US?

If legislation is passed that allows OTC listed US Cannabis companies to uplist to Nasdaq/NYSE, Canadian companies like High Tide and Tilray will get to sell THC products in the states in the US which have legalized cannabis. In this scenario High Tide gets to leverage the global customer database exceeding 4.6 million, including 3 million customers in the US. The US has tremendous potential when you factor in this existing US customer base. This potential can be leveraged through the horizontal integration of THC products, in addition to existing accessories and cannabinoid products.

The Canadian Cannabis Survey 2021 estimates that 25% of adult Canadians consumed Cannabis within the past 12 month of the survey. Assuming 20% of US adults (approximately 250 million) consume Cannabis, there are around 50 million cannabis consumers in the US. High Tide’s customer base of approximately 3 million US customers would be 6% of the US cannabis consumer base. These are knowledgeable and serious cannabis consumers, because they purchase accessories and cannabinoid products.

In the INVESTING category’s Cannabis Investing 1: Investment Opportunity of the Century? article, I estimate that the US cannabis market will grow from current US$30 billion to US$50 billion or more in 2025. 6% of US$50 billion would be US$3 billion. But even a modest 2% of that market would be US$ 1 billion. Based on this high-level math, post approval of High Tide selling THC products on ecommerce platforms, it is mathematically feasible for High Tide revenues to exceed the revenues projected in the Optimistic scenarios with the existing 6% customer base capturing 2% of market share. In the best case scenario, the customer base captures higher market share in the 2% to 6% range because these are knowledgeable customers who would likely buy on ecommerce platforms. But I will exclude that from the analysis for now and use more conservative estimates. There is also the potential for High Tide having retail stores in the US, and leveraging the distribution strengths and existing CBD facilities to further vertically integrate on products. These factors too I will exclude for now.

In the scenario of High Tide capturing 2% of the US cannabis market when THC sales are allowed on ecommerce platforms, the company’s revenue streams change completely. More than half of revenues will come from the US, and specifically from ecommerce sales with strong margins. When this happens, High Tide becomes eligible for inclusion in the AdvisorShares Pure US Cannabis ETF (Ticker MSOS), the largest Cannabis ETF globally, measured in terms of Assets Under Management (AUM). This would be a huge boost in institutional ownership, and will favorably impact share prices.

In summary, the optimistic case, however far fetched the numbers may seem, is mathematically feasible once High Tide is allowed to sell THC products on the various US ecommerce platforms. There are other potential catalysts like potential sales in Germany and other countries, post legalization. But these would be bonus scenarios for High Tide, and factors to watch as the investment thesis plays out.

FABCBD Sleep Gummies for nighttime use which has CBD along with natural ingredients like Ashwagandha, a herb used in Ayurveda, the ancient plant medicine of India

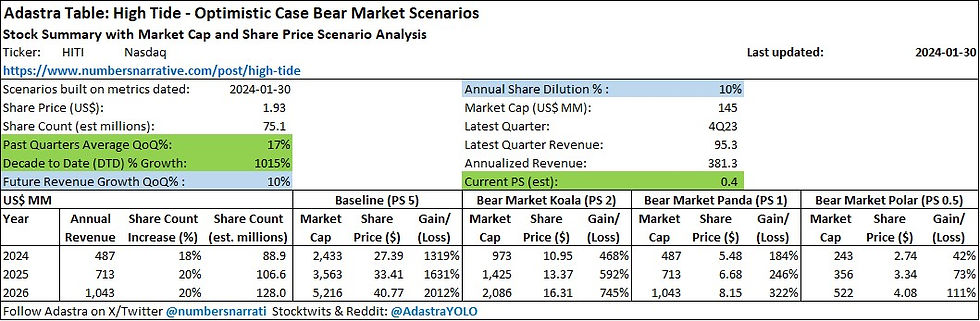

In the optimistic scenario also, in the short term there is a risk that the sector will remain out of favor and that valuations can remain low or even deteriorate further. It is important to model out Bear market scenarios based on Bear Market PS valuations (Koala Bear 2 PS, Panda Bear 1 PS, Polar Bear 0.5 PS). These Bear Market Scenarios are presented in the table below.

Additional Thoughts

In this section I will share some additional thoughts of mine, designed to provoke further thought and due diligence in readers.

As mentioned in my Cannabis Portfolio page, the true competitive advantage of retail comes from white label branded products. This has been a source of strength and superior margins for many retail companies like Costco (Kirkland brand) and Walmart (Great Value, etc). High Tide has already launched several white label products produced in agreement with Licensed Producers, to be sold in High Tide’s Canna Cabana stores across Canada. These white label (Cabana Cannabis Co.) products, contribute not just improved margins (through further vertical integration) but also higher revenues (through competitive pricing).

As I researched the cannabis sector I visited stores by Tokyo Smoke, a franchise model store network operated by Katz Group with the brand formerly owned by Canopy Growth. This has been discussed in the INVESTING category article Cannabis Investing 3: Apricots, Plums, Apriums, Apples, Tomatoes. Although I found the product prices at Tokyo Smoke to be high, I was very impressed by the large selection of products from Canopy Growth brands. While I could not accurately estimate what percentage of Tokyo Smoke sales came from Canopy brands, I estimate it to be somewhere in the 20% to 40% range. When High Tide launched white label products in Saskatchewan, they stated that long term they see white label sales to be 20% to 30% of total sales. As High Tide grows white label sales to that percentage range, the impact to margins and financials will be very beneficial.

For those like me who like consuming in the format of oils, FABCBD has CBD oils in different flavors and strengths

In the Optimistic case scenario described earlier on this page, ecommerce sales can skyrocket when regulations allow Nasdaq to approve listed companies to sell THC products in the US. This scenario has more than 50% of revenues coming from US ecommerce, with additional revenues from UK/Europe ecommerce and the Cabanalytics analytics platform. That would mean more than half the revenues would be contributed by ecommerce and data, being more accurately categorized as Technology, as opposed to traditional Brick and Mortar retail. Just these segments would justify a higher market cap for the company if they were recognized and valued with Technology multiples.

On the topic of Technology, High Tide’s acquisition of Fastendr™ Retail Kiosk and Smart Locker Technology is another Tech acquisition with strong future potential. This is a technology that High Tide has installed in several stores and is in the process of deploying to all their stores. As an automation play, it will help High Tide keep costs optimized while generating more revenues with lower costs, hence improving margins. In the future this technology can be licensed to other stores for a new Tech revenue stream, like Cabanalytics.

I am a huge believer in the power of automation for cost optimization. A lot of focus goes to revenue growth, but the truly great companies are those that focus both on revenue growth as well as on cost optimization, whether through cost savings or cost avoidance. These are topics I have significant work experience in and I often ask a simple question: what’s better, $1MM in revenue growth or $1MM in cost decrease?

Revenue growth is impressive no doubt. But in simplified terms:

Profit = Revenue - Cost

It the company spent $0.7MM to make the $1MM revenue, the profit would be $0.3MM. In contrast, there is a much bigger impact to the bottom line when you decrease costs by $1MM. This is a simple example and there are other factors like taxes, etc. But the example highlights the importance and impact of cost optimization. With automation (like Fastendr), each store can get higher revenues while minimizing the need to hire additional employees.

One more important factor for due diligence is the company’s management, specifically the CEO, Raj Grover. He is the largest shareholder and has never sold a share. His story is interesting and inspiring. He is a self-made immigrant and old school entrepreneur, who started High Tide from one store and built it into today’s global company. It always helps to see videos where CEOs get to talk about their companies and themselves. The following video with The Dales Report but well worth watching.

Given all that has been mentioned on this page, an important question to ask is – why is High Tide’s share price so low and valuation so low compared to peers?

As a shareholder I have thought about this often when I look at the underperformance of my investment. I can think of two answers that I would consider logical. The first is that High Tide is neither here nor there. As in, its not a Licensed Producer and hence is not included in the list of producers with Tilray, Canopy, Aurora etc that tend to trade a higher valuation metrics to others in the sector. High Tide is also not a US Multi State Operator (MSO), and hence does not have the support of loyal American investors who champion the US Cannabis industry and often use the hashtag #MSOGang. Being in neither category has led to less name recognition, and hence the company relatively unknown in spite of the advantage of being listed on Nasdaq.

The other answer is that (I believe) this stock is heavily manipulated by market makers and short sellers. The low volume of stocks traded makes this easy to manipulate. With a limited number of shares, the stock is often suppressed, triggering panic and stop losses from retail investors. These shares are accumulated via disproportionately high dark pool volumes, which can be seen on sites like Stockwatch.com. I have often also seen well orchestrated social media posts designed to cause Fear, Uncertainty and Doubt (FUD). On the stock’s Yahoo Finance page you also see toxic and racist posts by posters who seem to bash companies as their full time job. I was under the belief that short and distort is illegal, but you see this rampant in social media.

High Tide’s fundamentals and prospects are overall very strong and it features highly in the Best Cannabis Stocks Analysis. It happens to be one of my 3 top pick stocks, along with Curaleaf and Green Thumb. It is impossible for me to predict when the discrepancy between company value and share price will end. But as long as there is a valuation gap, this becomes a stock worthy of due diligence, and consideration in any Cannabis Portfolio.

One additional thought is about the differences in the US and Canadian Cannabis markets. Canada is a mature market with high competition. Margins have decreased since Cannabis was legalized in 2018. The US market is still in the early stages with higher margins, and high growth potential with a large illicit market and many states still to legalize. If High Tide can deliver such growth in Canada under such challenging conditions, imagine how well they will perform when they can operate in the US. Imagine how they will perform when a new market like Germany opens up.

FABCBD CBD cream is gaining in popularity, made along with healthy ingredients including Aloe Vera Leaf Extract, Cocoa Butter and Coconut Oil

Information sources and charts

As mentioned, the Investor Presentation and Financial results are a must read for any current or new investor.

You can also stay informed by following the company and CEO on Twitter and joining the conversation with fellow investors on Stocktwits and Reddit. High Tide is active on Twitter @HighTide_HITI and the Canna Cabana stores use handle @CannaCabana_.

The CEO, Raj Grover is also active on Twitter and can be followed @RajGrover_HITI.

High Tide has a large watcher list and active investor community on the Stocktwits High Tide page. I am active in this community and often post on the Stocktwits page.

High Tide also has an active Reddit community. Raj Grover has done Ask Me Anything (AMA) sessions in the past on Reddit. Raj's latest Reddit AMA was on Thursday November 16th. Link with his detailed answers to investors' questions:

But the ultimate form of research in my opinion is boots on the ground research. I am a Cabana Club member and have shopped at multiple Canna Cabana stores in Toronto and Niagara Falls. I make it a point to talk to the staff and see the products, layout, customer traffic etc. I found the staff to be knowledgeable and have always had a great customer experience. As a frugal shopper, price is very important to me. Prices are displayed on the Canna Cabana website and can be easily compared to competitors. Visiting the website to compare prices is an easy way for current/new investors to do due diligence. The low prices, combined with good quality of products make it obvious why the loyalty program grew in excess of 1 million members so soon after the program launched. I would not be surprised to see these numbers grow further as more stores are launched and more customers switch from higher priced competitors. This is the kind of consolidation we have seen in the past with Costco and Walmart.

For those near a Canna Cabana store or visiting a city with one, as part of due diligence I would recommend a trip to a retail store to do first hand boots on the ground research. You can see the see the Canna Cabana locations listed in the provinces of Alberta, Manitoba, Ontario, Saskatchewan and British Columbia (soon). On Stocktwits we often see investors who happen to be customers, sharing pictures and their experiences. This is another way to stay informed.

The following are charts from TradingView that can be clicked on for more detailed charts and data.

This page, along with the analysis and tables included will be updated on a regular basis. If you are a HIgh Tide shareholder who wants to stay stay informed, feel free to add this page to your browser favorites.

If you find any article here worth sharing, please share via the social media share options. If you are interested in connecting, you can do so on Twitter (@numbersnarrati) and Stocktwits (@AdastraYOLO). To support, please check out the affiliate links (especially CBD and other cannabinoid products) or become a Patron via the Numbers Narrative Patreon Page.

Disclaimer: All content and analysis on this Blog/website is information shared for educational and entertainment purposes only. The content creator(s) of this Blog are not financial advisors and the content is not intended to provide advice or recommendations for any security, investment product or any other product or service mentioned on this Blog. You should not use this Blog to make financial decisions and you should instead seek advice from professionals who are authorized to provide investment advice. Although best efforts have been taken to keep the information on this Blog accurate, this Blog may contain errors and inaccuracies. You alone assume the sole responsibility of the risks associated with the use of any content on the Blog. In no event shall any of the content creators be liable for any damages in connection with the information contained in this Blog or links provided.

Disclosure: I (username Adastra) am an investor not a trader. I am bullish on the Cannabis sector as a long-term investment (2026 and beyond), provided stocks/ETFs are carefully picked based on data-driven due diligence. Of the 16 stocks covered in the Best Cannabis Stocks analysis, I have invested only in my top 3 picks: High Tide, Green Thumb and Curaleaf. But my analysis indicates (without any guarantees) that there is a potential for impressive gains in investing in the stocks best ranked in the analysis, including WM Technology, and Trulieve, which have a dedicated page with detailed analysis in the STOCKS category. I reserve the right to buy or sell at any time any of the stocks mentioned in this blog. I do not short stocks and never will short any stock in a company that makes the world a better place. I do not have insider knowledge of any company covered in this blog. All data used for analysis is from public sources. I have received (as of last update date of this page) ZERO funding for this blog from any of the companies featured in this blog.

Comments